Laxmikant Shetgaonkar | Offcial Website

Better Financial Incentives And Campaigns out of 2025

Articles

Certainly MMA recipients, 40/47 joint liver‐renal receiver received whole livers. Among those finding remote the liver transplants 6/41 got lifestyle donors and you may 10/41 had limited grafts of inactive donors. Among all of the MMA recipients, 5/7 graft failure occurrences as well as cuatro/5 death incidents taken place inside 60 days out of transplant. Four of these events, as well as three within this 60 days, took place people that obtained entire livers. Among the PA recipients choosing separated liver transplants, 37 received entire livers out of dead donors, 27 gotten partial livers away from dead donors, and step three had life donors.

The netherlands The united states Line Also offers $step one Places for one Go out

It is offering a two-12 months fixed speed during the 5.99% which have a good £999 commission (85% LTV) for consumers taking the ‘homebuyer package’, in which they normally use Gen H’s conveyancing and you can judge provider. The bank’s a few- and you can about three-year repaired costs for residential house pick to possess people having at the least an excellent 40% cash deposit (60% mortgage to help you value) has fell to three.97% and you may 3.99% respectively, each other which have a great £999 percentage. Halifax, great britain’s prominent mortgage lender, also has slashed remortgage repaired prices across the an over-all listing of sale by the as much as 0.1 payment things. Two-season remortgage repaired costs today cover anything from cuatro.10% (60% LTV) having a great £step one,999 percentage or away from 4.18% to your comparable five-season deal.

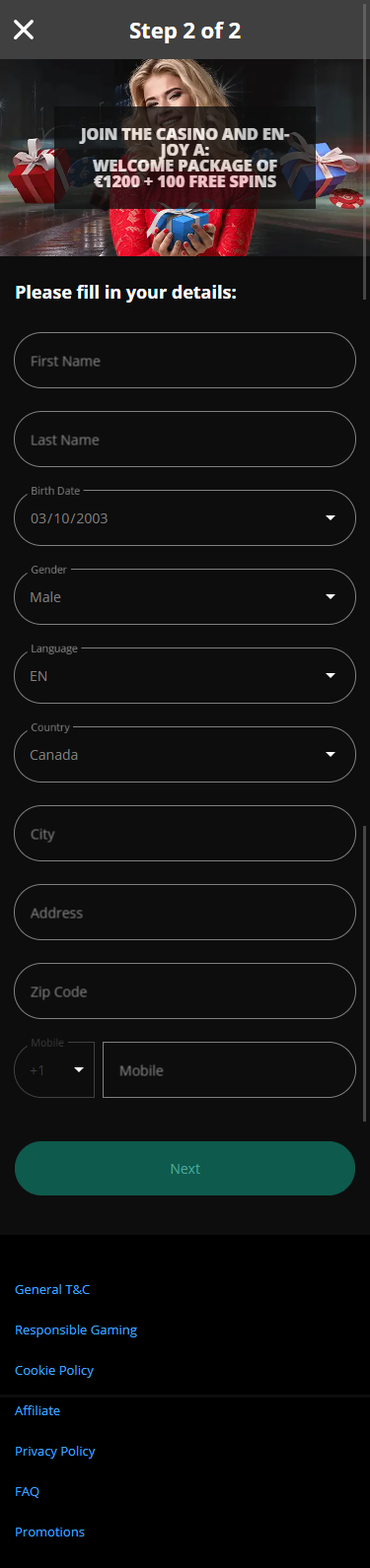

Sort of No deposit Extra Casino Also provides Explained

The newest online casinos tend to either provide participants bucks incentives to own joining. Normally, it would be a tiny free bonus matter – for example $25 that may should be wagered inside the a day. Meanwhile, NatWest has released a sub-4% fix for customers just who bypass lenders and you will go head to the bank as an alternative. The 3.97% package can be obtained on the web simply, so you can borrowers having at the least a great 40% deposit (60% LTV) willing to protected for 5 decades, and comes with a charge away from £step one,495 – whether or not NatWest do afford the valuation percentage for your requirements. Santander also has verified it will peg down will cost you of chosen residential fixed speed mortgage loans for new people of the next day, because of the as much as 0.19%.

HSBC, Barclays and Santander is actually certainly one of some lenders providing fixed costs at under cuatro% (see story below), whether or not these types of rates essentially have standards or high fees. Such, HSBC Biggest consumers, just who must have annual earnings otherwise deals of at least £one hundred,000, get a speeds from step 3.98% to your a good four-12 months enhance with a £999 fee. Certainly its the new sale, NatWest offers a charge-100 percent free pick rate during the 4.8% to own borrowers with an excellent 10% cash deposit (90% loan to help you worth). TSB has slash chosen two and you may four-12 months fixed price BTL selling for brand new and you may existing people from the to 0.dos percentage points (active out of tomorrow, twenty eight March). HSBC features released a variety of purchase-to-help selling for its Prominent banking consumers. The 2- and you will five-year repaired rates selling are available to those individuals to purchase or remortgaging at the anywhere between sixty% loan to help you really worth (LTV) and you may 80% LTV.

Nationwide even offers lowered fixed cost to possess basic-day customers, household moving companies and remortgage consumers. Its a few-seasons fixed-rates bargain to have remortgage starts from step three.89%, also for individuals that have an excellent £three hundred,100000 home loan or even more and also at least 40% guarantee in their house (60% LTV). HSBC provides launched cuts to help you chose domestic fixed rates from Friday in the future (5 August). The newest prices and you may sale, readily available as a result of brokers, will be disclosed on the internet next week.

Of these, happy-gambler.com use a weblink twenty-four (58.5%) features reached mucosal healing (MH), and you may eleven (twenty-six.8%) have attained both MH and histologic remission. 36% of your 32 for the cutting-edge therapies receive high‐than‐fundamental dosing. Among the 33 patients that have tried state-of-the-art treatments, the newest average many years from the therapy initiation try 7.0 (cuatro.5‐11.8) yrs. Of one’s 19 whom did not act, 9 failed to respond to you to definitely cutting-edge medication, 7 to a few cutting-edge treatment and you may 3 to three cutting-edge treatment. Healing treatments monitoring (TDM) are did inside the 32 patients, away from which 19 (57.6%) demonstrated lower levels demanding dosage modifications or immunomodulator treatment.

How to pick an informed no-deposit added bonus for your requirements within the Oct 2025

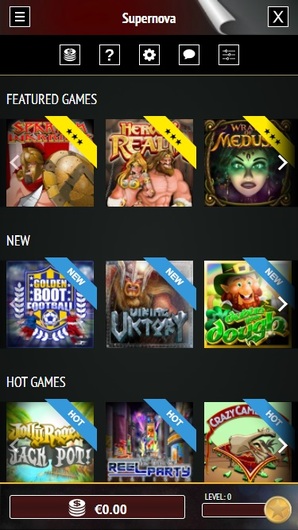

Here is the merely lender on the the list who has numerous from financial branches, and their cafes, while also providing a competitive produce to your its offers issues. If you want to have the option of conversing with an excellent human regarding the tissue, so it savings account could be right for you. Money One to 360 Efficiency Offers is a great possibilities if you’lso are looking for a high-yield bank account with the ability to financial myself when you are avoiding most charges and lowest requirements. Risk.us try a good cryptocurrency gambling enterprise that give new users with an excellent 550,000 GC and you will $55 Sc no-put bonus, just for joining and you will log in each day for thirty day period. The platform also provides more than 500 games from legitimate company for example Pragmatic Gamble and you can Hacksaw Gaming, and it has its group of Share Originals headings. The expert articles are built to elevates of student to specialist on your expertise in casinos on the internet, gambling establishment bonuses, T&Cs, terminology, game and you may all things in anywhere between.

Some games try slots, Pulsz even offers Colorado Keep ‘Em, roulette, and black-jack, offering more range than just normal ports-merely sweepstakes casinos. Pulsz phone calls in itself an excellent “free-to-gamble personal gambling establishment,” however it’s an established sweepstakes web site where you are able to earn real cash. Issues can usually become used to own benefits such as added bonus spins otherwise financing. Eligible taxpayers can expect to get the money possibly from the lead put or a newsprint check in the brand new post. They will along with discover another letter alerting him or her about the fee.

Virgin often peg off four-seasons fixed-rates cost by the 0.21 base things to do a great step three.99% manage a great £995 commission. The deal means a minimum deposit away from twenty-five%, maybe not the fresh 40% required by their competitors. So far, a decreased four-year price to possess house pick, offered by Barclays, got cut to step three.84% (otherwise step 3.83% to have Premier most recent membership consumers) to own borrowers that have at least a good 40% bucks deposit to have an excellent £899 fee. Across the country strengthening neighborhood features trimmed the price of its repaired rate home loan product sales because of the as much as 0.dos fee items, doing another four-season fixed bargain for home moving services priced at leading step three.83%, writes Jo Thornhill. Both sale are available to home buyers and you will moving services having from the least a 40% deposit. But NatWest’s offering must be applied for and you will handled only from lender’s webpages that is unavailable because of mortgage brokers.

One of ideal policy alter, the new FCA is seeking loan providers to really make it more comfortable for customers to access lesser mortgage sales and change the definition of away from its mortgage, to reduce full costs. To have limited organization BTL sales, there is a two-year package for purchase otherwise remortgage from the cuatro.14% which have a step three% fee, and up to 75% LTV. Barclays, Santander, TSB plus the Financial Work have shorter the repaired rates costs after the last week’s quarter percentage-area move the lending company Rates, produces Jo Thornhill. Agents have welcomed the newest discharge of a couple of ‘100%’ financial sales for customers who’ve no money put to the their buy, produces Jo Thornhill. The very first-day customer and you may household mover cost are set-to rise from the up to 0.step one fee points.

That’s why more 20% away from professionals who allege a plus through NoDepositKings return continuously to get more excellent deals. Survey distribution focused clinicians who do work with people having health questions and who incorporate a keen EMR program to deliver worry. Postoperative manometry is performed in the 4 clients, which have a mean IRP away from cuatro mmHg, DCI of 730 mmHg.s.cm, and you can panesophageal pressurization inside the 75%. Four patients that have postoperative strictures underwent additional interventions as well as balloon dilation. A keen observational examination of the fresh MF to possess clients more than 1 season old which have diagnoses for example short intestinal problem, persistent diarrhea, and malabsorption is being conducted to further establish such findings.

Simultaneously, just after passing rigid gaming something, one progress produced from a no deposit bonus might become removed right back. Based on your needs, the right place to suit your deposits will be discounts, desire examining, Cds, MMAs or a variety of such accounts. Irrespective of where you deposit your money, definitely hold the account’s interest in your mind. It is an important factor in helping you build your bank balance and satisfy debt wants. Be sure to’lso are willing to meet such criteria before you sign up for a keen membership.

The interest rate for the its five-year Great Eliminate fixed speed to have remortgage, and this will not charge charge, has grown out of cuatro.08% to help you cuatro.18% (60% mortgage to value). The bank’s a few-season fixed speed Premier package to have home get (to have Prominent financial users) went up out of step three.74% to three.84% (60% LTV). Virgin Currency, the newest credit brand owned by Nationwide, are expanding chose residential and get-to-let fixed rates from the around 0.22 percentage items of 5 Sep.